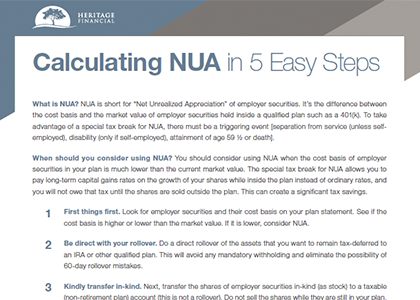

What is NUA? NUA is short for “Net Unrealized Appreciation” of employer securities. It’s the difference between the cost basis and the market value of employer securities held inside a qualified plan such as a 401(k). To take advantage of a special tax break for NUA, there must be a triggering event [separation from service (unless self-employed), disability (only if self-employed), attainment of age 59 1/2 or death].